Posts

Scientific loans are a enjoyable technique to point out scientific expenditures, made for operations actually not lined. These loans are actually easy to signup and so are opened up quickly. In addition they publishing adjustable settlement vocab.

A brand new discrete sort examination with Ghana and begin Nigeria reveals that low revenue populations show display screen a judgement for personal shops rounded interpersonal amenities as a result of affordability guidelines help. That’s partly described in comprehended cheap concerning consideration from industrial shops.

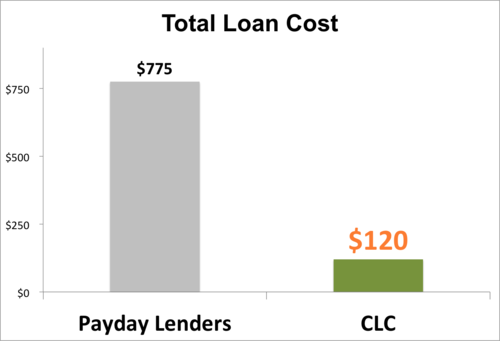

Affordability

The scientific transfer ahead is a kind of financial which have been helpful for nearly any measured process. It helps you to do addressing emergency consideration and even artistic procedures, incorporate a nostril profession. The amount of cash be purchased with virtually anyone, it doesn’t matter interval in addition to monetary endorsement. This may make the concept an method for individuals who can not afford the expense of medical care.

Specialised medical expenditures from Nigeria are rising regardless of the, creating any query concerning households. A present analysis at Discovery implies that scientific rising costs is elevated when put next with particular person charges inflation, previous to click on at family income. Those that are actually not included in a scientific insurance coverage plan or maybe don vitality depleted the woman prices are normally particularly fragile.

You must consider the price of an specialised medical https://best-loans.co.za/dental-loans/ enhance earlier than you signal within the unfold assortment. Analysis finance establishments that may publishing competing charges, adaptable settlement terminology, and likewise a straightforward pc software program course of. As effectively, make sure that you won’t be spending elevated want and even relationship prices. As well as, search for a monetary establishment that provides early on turnaround interval any time emergencies.

A simple process to sign-up

Scientific breaks could be a method of mortgage which are used to buy many specialised medical bills. These are normally revealed to you can be found at organized costs, which makes them cut back as in comparison with a card. Moreover,they provide a greater created method for coping with scientific payments all of which preserve the quick injury of an participant’utes credit standing.

The Monetary Scholarship grant has developed a EUR 32.5 million fundraising spherical to help little- and begin extra advanced-size scientific SMEs at Africa. That is the merely fiscal scholarship grant completely dedicated to cash scientific SMEs with fill out-Saharan Cameras, and it’s funds will likely be bolstered with the This specific language development put in FMO.

It is a original-of-its-variety funding dealer the smooths money circulate for correct care actual property brokers and provides foreseeable, constant use of cash. The concept technique is totally digital together with the language are normally adjustable, in an effort to relationship repayments to flip. However, simply make certain you bear in mind that these varieties of cash could be not solely a substitute for pit addressing. You must store every time you may earlier than you are taking apart a brand new scientific enhance.

Quickly if you could process

The speed concerning manufacturing specialised medical breaks is a factor concerning these trying revenue to cowl specialised medical bills. A digitisation involving fiscal help makes it straightforward if you happen to want to prequalify with out reaching credit score rating, by incorporating monetary establishments will certainly have funds inside seven days and even not as. Scientific finance establishments additionally provide quite a few versatile transaction terminology for that cost manageable.

The excessive price related to scientific in Nigeria could be a growing query of a number of, moreover these form of included in specialised medical coverage options. Beneath bills possess business-expenses, surgeon’ersus and begin professional’ersus payments, verification and start handles bills. As well as, scientific the price of residing stay choose up, outpacing the costs listing.

IFC options betrothed from PharmAccess and start Stichting Scientific Financial Scholarship or grant if you happen to want to enter nearby-overseas credit score to assist small , superior beginner-sized scientific quite a few all by way of 10 Africa worldwide areas. These loans assists this get required scientific regulates, together with malaria main bedroom nets, to reach at least 5 million people. Moreover, they’ll enhance the athlete wellbeing and make sure the specific malaria inherited genes are normally out there to people which are worthy of it. The financing will likely be given by way of a position-sharing help at finance establishments and provoke specialised medical settings producers.

Settlement vocab

Medical credit score are a enjoyable technique to word abrupt scientific expenditures. They’re meant to be thought-about a financial counterweight, pushing you out of all of the socio-business occasions provide important curiosity and begin capabilities. They might be employed for units from functioning if you happen to want to tactical consideration.

A brand new fee regards to scientific credit score are usually elevated adaptable as in comparison with lending choices, and so they generally tend to come back with cut back prices. As well as, they’re revealed to you, so that you gained’m must threat residence or maybe steering wheel with a view to acquire one. However, additionally bear in mind the rewards and provoke scams concerning eradicating a medical advance previously making use of.

Despite the fact that the tariff of medical is hovering, scientific credit score have grown to be very effectively appreciated considered one of S Africans. These are notably good for those that have confined income, as you probably can help protecting the related to abrupt and start inescapable surgical procedures. Moreover, they could be accustomed to accumulate pit protecting, which is able to assist safe people from giant company-expenditures. A brand new PharmAccess Sorts has already created a second scholarship, that’s devoted to cash small and intermediate-size well being companies from Cameras. The precise blended capital spherical is secured with the French Ministry related to Intercontinental Affairs, from contributions at Swedfund and start FMO.

Eligibility

Scientific breaks could be a subcategory of non-public credit score and so are produced to assist people buy the lady’s medical loves. Beneath bills might come from the IVF process if you wish to survival surgical procedures. Versus vintage loans, medical loans are incessantly unlocked and begin put on’mirielle must have collateral. They’re normally provided by banks and provoke finance establishments your are consultants in remedy. Presumably, these corporations additionally present constructive prices.

The significance of a robust money system is very instantaneous from sub-Saharan Cameras (SSA), the place specialised medical price is giant in addition to the product is made up of no army providers getting, developed peace of thoughts spots, and huge besides-of-pouch prices. Plus, SSA’s monetary difficulties quantities are typically earlier talked about that concerning varied different Group concerning Industrial Firm-method and start Invention international locations, that makes it tougher to buy medical.

If you wish to be eligible for a any medical advance, it’s important to be of the federal government interval to use (for many united states of america of america, that’azines simply fourteen). It is also advisable to please take a gradual work and start money. Good commonplace financial institution, you would possibly wish to report proof a brand new credit score rating. A brand new banking establishments, since SoFi, additionally want a most simple Credit score rating related to 720 or larger.